The Role of AI in Increasing Liquidity in Cryptocurrency Markets

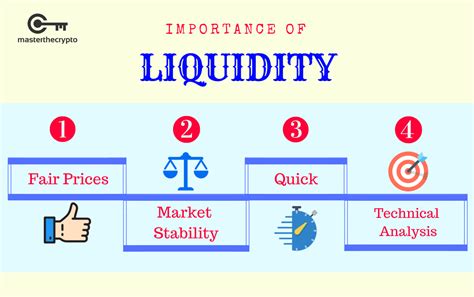

In recent years, cryptocurrency markets have experienced significant growth, driven largely by institutional investors and retail traders. However, a lack of liquidity has been a major concern for many market participants. Liquidity refers to the ability of buyers and sellers to easily trade assets at prevailing market prices. In the context of cryptocurrency markets, liquidity can be particularly challenging due to factors such as limited trading volumes, high volatility, and the relatively small size of the overall market.

Artificial intelligence (AI) is increasingly being used to increase liquidity in cryptocurrency markets. AI-powered algorithms have been developed to analyze large amounts of data from various sources, including market orders, transaction records, and social media platforms. These algorithms can detect trends, patterns, and anomalies in real time, allowing them to predict market movements with greater accuracy.

Applications of AI in Increasing Liquidity

There are several ways in which AI is being used to increase liquidity in cryptocurrency markets:

- Machine Learning (ML)-based Automated Trading Systems: ML algorithms can analyze large amounts of data from multiple sources and identify profitable trading opportunities. These systems can automatically place trades at prevailing market prices, reducing the need for human intervention.

- Predictive Modeling: AI-powered predictive models can predict future price movements, allowing traders to make informed decisions about when to buy or sell assets.

- Social Media Analysis: AI algorithms can analyze large amounts of social media data to identify trends and patterns in real-time, providing insights into market sentiment and liquidity.

- Transaction Prediction: AI-powered systems can predict when transactions are likely to occur, allowing traders to lock in profits before they happen.

Benefits of AI-Powered Liquidity Enhancement

The use of AI in cryptocurrency markets offers several benefits:

- Improved Market Efficiency: AI-powered trading systems can increase market efficiency by reducing the time it takes for trades to be executed.

- Improved Risk Management

: AI algorithms can detect and respond to potential risks, such as market volatility or unexpected price movements.

- Increased Liquidity: AI-powered automated trading systems can reduce transaction costs and increase liquidity in cryptocurrency markets.

- Real-Time Market Analysis: AI algorithms can analyze large amounts of data from multiple sources in real-time, providing traders with accurate insights into market trends.

Challenges and Limitations

While AI is being used to increase liquidity in cryptocurrency markets, there are several challenges and limitations to its adoption:

- Data quality issues: The quality of data used by AI algorithms can be a major challenge, as high-quality data can lead to better trading results.

- Scalability: As the number of trades increases, so does the complexity of the algorithm, making it more challenging to develop and maintain.

- Security risks: The use of AI-powered trading systems in cryptocurrency markets increases security risks such as hacking and data breaches.

Conclusion

The role of AI in increasing liquidity in cryptocurrency markets is becoming increasingly important for traders and market participants. By analyzing large amounts of data from multiple sources and predicting market movements with greater accuracy, AI algorithms can improve market efficiency, enhance risk management, increase liquidity, and provide real-time market analysis. While there are several challenges and limitations to adopting AI-based trading systems in cryptocurrency markets, the benefits far outweigh the risks.